Simply Investments Advisory Service

For clients seeking a cost-effective portfolio management solution, KISFP offers the Simply Investments Advisory Service. Starting at only .50% of AUM (assets under management), this service empowers clients to establish an investment account, automate deposits, and select from a diverse range of professionally managed investment portfolios tailored to help them achieve their financial goals.

We offer primarily professionally managed Dimensional Funds portfolios or Vanguard index ETF’s if requested.

Learn more about our investment philosophy.

Key Features

-

Our team of experienced investment professionals has constructed and actively manages a variety of investment allocation models, each comprising a carefully selected mix of exchange-traded funds (ETFs) and/or mutual funds.

-

We employ tax-efficient investing strategies to help maximize your after-tax returns and minimize the impact of taxes on your investment growth.

-

Your portfolio will be periodically rebalanced to maintain your desired asset allocation, ensuring that your investments remain aligned with your risk tolerance and goals.

-

You can easily set up and manage account distributions to meet your income needs or other financial obligations.

-

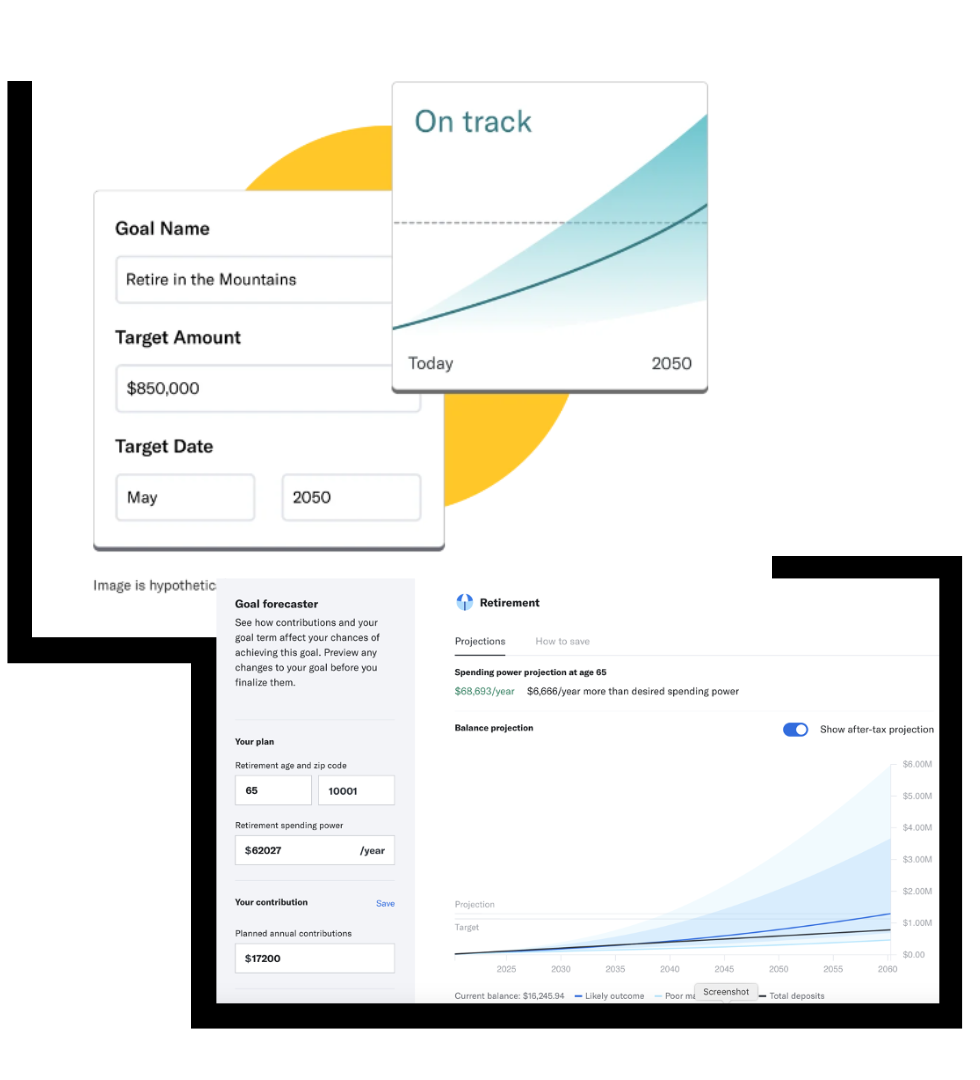

Our intuitive goal tracking tools allow you to monitor your progress towards your investment goals and make informed decisions about your financial future.

-

When needed, you have the option to engage with one of our skilled financial planners for personalized guidance and support.

The Simply Investments Advisory Service is an excellent choice for clients who prefer a professional approach to portfolio management, while still having access to expertise and support when required. With KISFP's Simply Investments Advisory Service, you can invest with confidence, knowing that your portfolio is being managed by a team of experienced professionals dedicated to helping you achieve your financial goals.

Our minimum annual fee for this service is $2,400/year with no minimum assets under management.